17+ mortgage tax nyc

Say an initial mortgage was for 1 million and the seller paid it down over the time to 900000. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

Clifton Park North Pennysaver 081111 By Capital Region Weekly Newspapers Issuu

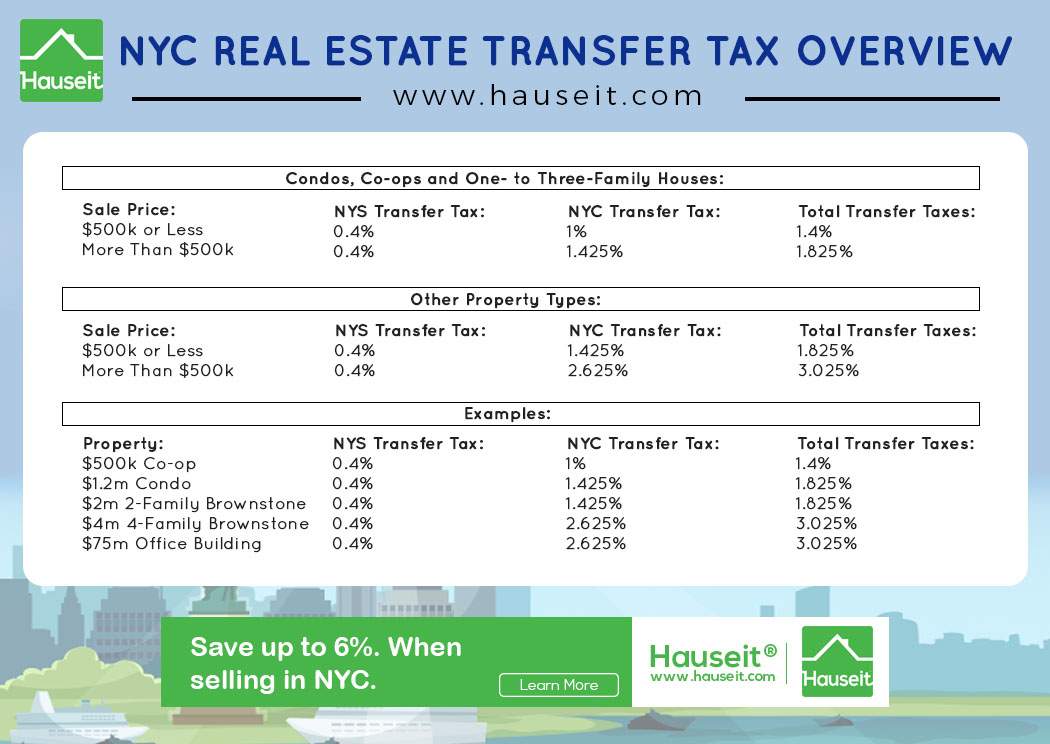

Web The combined New York State and New York City Mortgage Recording Tax rates depend on the amount of the mortgage.

. Getting ready to buy a. Web basic tax of 50 cents per 100 of mortgage debt or obligation secured. Web Heres how it works.

When a mortgage is issued and recorded for a City property the property owner must pay both City and State Mortgage Recording Taxes. Companies are required by law to send W-2 forms to. Compare offers from our partners side by side and find the perfect lender for you.

The good news is there are some property tax exemptions for New. Web Todays mortgage rates in New York are 7050 for a 30-year fixed 6046 for a 15-year fixed and 7054 for a 5-year adjustable-rate mortgage ARM. Web 1 day agoImportant tax documents like your W-2 form and 1099 forms for income should have been mailed to you by now.

Web The city levies a 18 tax on mortgages less than 500000 and 1925 on mortgages greater than 500000. A basic tax rate. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

See Prior Ownership History Sales Records Property Deed So Much More. Ad Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Special additional tax of 25 cents per 100 of mortgage debt or obligation secured.

If the mortgage was then assigned for 1 million. Web The real property tax credit may be available to New York State residents who have household gross incomes of 18000 or less and pay either real property. Web New York State Tax.

Web Mortgage Recording Tax. Ad Taxes Can Be Complex. These amounts include a New York state levy of.

Web New York tax rates are calculated in millage rates. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. Web New York State Tax.

A basic tax rate. Ad Find Out the Market Value of Any Property and Past Sale Prices. We Explain Changes In Your Tax Refund And Provide Tips To Get Your Biggest Refund.

In addition to the City tax New York State imposes a statewide Mortgage Recording Tax which consists of the following components. Web The mortgage recording tax requires purchasers to pay 18 on mortgage amounts under 500000 and 1925 on mortgage amounts above 500000 in NYC. In addition to the City tax New York State imposes a statewide Mortgage Recording Tax which consists of the following components.

One mill is equal to 1 of tax per 1000 in property value. For help calculating the amount of tax due we.

How Much Are Seller Transfer Taxes In Nyc Infographic Portal

60 Park Circle White Plains Ny 10603 Mls H6232072 Trulia

Mortgage Recording Tax All You Need To Know Blocks Lots

The Complete Guide To The Nyc Mortgage Recording Tax Yoreevo Yoreevo

17 Southminster Drive White Plains Ny 10604 Trulia

Newsletter March 5 2020

Chf Transitioning Guide

Nyc Mortgage Recording Tax 2023 Buyer S Guide Prevu

Nyc Mortgage Recording Tax 2023 Buyer S Guide Prevu

Newsletter March 5 2020

Pdf Rethinking Property Tax Incentives For Business Rethinking Property Tax Incentives For Business

Lidl Asia Pte Limited On Linkedin Lidlasiaexpats Hyesung

The Mortgage Recording Tax In Nyc Explained By Hauseit Medium

Saving On Mortgage Taxes Mortgages The New York Times

12762 Ny Real Estate Homes For Sale Redfin

The Complete Guide To The Nyc Mortgage Recording Tax Yoreevo Yoreevo

The Complete Guide To The Nyc Mortgage Recording Tax